About 'college debt average'|Average College Debt Rose to $24,000 in 2009

College tuition fee is rising everywhere, and in fact; it has been rising at much greater rate than any other items. For many families, sending children to universities mean a huge financial burden for the family, and for those taking up student loans, they will find themselves heavily indebted before they even find their first job. This unfortunately, will become worse in years to come, many are suggesting that university fees could rise to average $40,000 to $50,000 each year easily, and if you adding cost of accommodation and other costs, they can go up to $100,000. This is becoming a crisis that many parents are thinking to give up on their retirement money as they have choice The only way is to plan way ahead and start making savings as early as possible to avoid the future financial burden. 1. College Fund is a very good idea The concept of college fund is well understood in North America and certain parts of Europe. Some governments even put in incentives to co-invest into your education funds. The concept is very similar to your retirement fund; most people use mutual funds as a way to put regular savings into college fund. One thing to remember is, college fund is a very long term investment, usually 10 to 15 years; you need a balanced approach -- it is a good idea to mix them with stable and more aggressive investments; and not entirely on cash or stable investments as you do need to beat the inflation as college tuition fees do rise above inflation rate. 2. One share a year makes a lot of difference Buying one share for your children at their birthday or Christmas. I read a story where a grandmother used to buy one share a year for her birthday, over 14 years, she had accumulated wealth of $7,000; however, she had sold her shares every year in exchange for cash, had she kept them, it would worth $44,000, enough for her to pay off her college. There are many companies now offering this kind of service, and you can choose a variety of the companies to invest -- they will also send you a share certificate, so it is a perfect way to teach your kids money-sense at same time. 3. Open High Interest Kids Accounts Some Australian banks offer excellent interest rates for kids bank accounts. The best available at moment is 10%, although there are many restrictions that they can not earn over $400 a year or they will be taxed at very high margin rate. Still, saving $400 a year means you can save $4,000 over 10 years simply by parking your money there doing nothing. To make this work more effectively, is to link the accounts to your online high interest savings account which are paying around 6% per annum at moment, so you can accumulate interest both ways. 4. Buy Index Funds Regularly Index funds are very suitable tools for savings as they are highly diversified by its nature. Index funds perform almost exactly to the sharemarket index, and as the result, it is low-cost, low-maintenance funds to invest, the low-cost feature makes a lot of difference over a long term. Index funds are also easy to invest, you do not need to worry about picking the fund manager or the portfolio. 5. Research into different types of scholarships Scholarships are available at various universities, more so for universities in USA, Europe and also some parts of Asia. While it is not as common in Australia, there is still a funding available. The system works quite differently in US and Europe; scholarships are funded by Government, large corporations, alumni and foundations. For example, Bill Gates, Al Gore, Steve Jobs all have their foundations providing funding for scholarships for their universities. Scholarships come in different ways: 1) Academic 2) Sports Achievements 3) Music, Arts, talent 4) Innovations and 5) High achievers which is subject to judgment by the foundations and universities. 6. ETF Funds I use a lot of ETF Funds for my children's college funds; I like them for 3 reasons: 1) Easy to invest, as they are just like shares, 2) Liquidity, I can buy and sell them within 20 seconds unlike the mutual funds and 3) Choice, there is a wide range of choice of ETFs to choose from, which I can build them up over time. 7. High Dividend Stocks For long term savings, dividends will have a more influential role. As I had illustrated before, imagine a portfolio that generates 4% dividend yield a year on average and grows a modest 5% a year, that equates to 9% return a year already, plus many companies also increase their dividend by around 5% to 10% each year, and this can make a lot of difference after 10 years. 8. Save all your pocket money Most families have a lot of coins and changes sitting around. We did a study in 2010 and found that on average, there will be around $100 changes sitting in the household at any given time. This is a complete waste of money and opportunity as you can use them and earn interest or invest them into mutual funds. We started our first college fund like this way and simply deposit our changes at the end of each month, this has grown to $1,600 already just after 7 months. 9. Considering studying abroad Why staying in Australia? There is no reason why your kids should study in Australia. There are many countries in the world which actually offer university at much more affordable tuition fee. Many European universities are actually free apart from registration fees; some universities in Asia are also relatively cheap to attend -- look at different choices and you maybe surprised. 10. Discipline is everything As you can see, mutual funds, dividend paying companies, index funds -- these are really just the tools. The most important thing is discipline, and the best way to achieve that is "Forced Saving". Every family has ups and downs every month, but this should not disrupt your savings plans. A good way is to set up direct payment to the funds each month, so that you allocate certain amount of funds from your bank account. I have seen many of my friends now in the mid-30s and still need to pay off their college debt, it also caused subsequent consequences such as delaying their ability to buy their first home. Debt is a real problem faced by this generation and you can imagine it will be an even worse problem for the next generation. Do whatever you can for your children to save for their college, even $5000 can make a lot of difference for their future. |

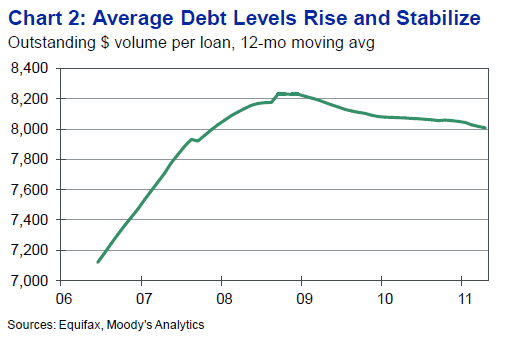

Image of college debt average

college debt average Image 1

college debt average Image 2

college debt average Image 3

college debt average Image 4

college debt average Image 5

Related blog with college debt average

- crystalfairweather.wordpress.com/[not surprised.] College seniors who graduated in 2009 had an average of $24,000 in student loan debt, up 6 percent from 2008, according...

- rexmartinez.wordpress.com/... an honor roll of sorts: 28 "low debt" colleges and universities whose average graduates are less than $10,000 in the...

- my-wealth-builder.blogspot.com/..., potential aid and average student loan debt at these colleges. I was pleasantly ...925 $22,126 $21,687 28 Bentley College (Mass.) 4,294 $41,300 $24,545...

- studentlendinganalytics.typepad.com/... to 4.6, and half of college students had...credit card balances. The average (mean) balance grew to... conducted. Median debt grew from 2004’s $946...

- warlords2010.blogspot.com/... in the class of 2011 who borrowed in college graduated with an average of $26,600 in loan debt, up from $25,250 the year before.

- studentlendinganalytics.typepad.com/...over the Class of 2006. Average debt for the class of 2007 was $18,482 at public colleges Average debt for the class of 2007 was $23,065 at private colleges The report ...

- findingcollege.blogspot.com/... to the College Board report linked to above, for 2003-04 college graduates, the average debt students incur is $19,300. According to the report...

- rougeknights.blogspot.com/...Australia (2007) $40 billion (AUD) [3] Credit card debt is said to be ... countries. The average U.S. college graduate begins his or her post...

- dandelionsalad.wordpress.com/...average debt load of a Canadian university graduate in 2009 was $26,680, and the average debt for college graduates was $13,600. These figures, it should be...

- inchoaterandomabstractions.blogspot.com/... get quick education about debt .' The average graduate who borrowed for college leaves school with almost... with pretty much zero debt because what the scholarship and...

College Debt Average - Blog Homepage Results

... with over $20,000 in student loan debt alone. Add on consumer/credit card debt, and the average college student can be $25,000-35,000 in debt before he/she gets his/her first full-time...

Related Video with college debt average

college debt average Video 1

college debt average Video 2

college debt average Video 3

0 개의 댓글:

댓글 쓰기