About 'average debt of college students'|Trends in College Tuition vs. Bachelor’s Degree Wages; Interesting Demographics of Student Loan Debt History

One of the most important aspects to financial security involves maintaining an appropriate credit score. For many college students, credit cards have become a way to extend not only the finances associated with daily living but also a method in which to maintain entertainment, often to an extreme. With many college students obtaining student loans, it is crucial to avoid surmounting credit card debt as this will only lead to a double whammy once college life is over. Teaching children, especially during high school, the concept of credit scoring will work to ensure more educated financial decisions are made in college. Credit scores, known as FICO scores, are scoring mechanisms provided by the three major, national credit bureaus. While each credit bureau will provide a difference FICO credit score, the average of these scores is a good indicator of the credit worthiness of a college student. While many college students rarely have established credit scores by the time they reach college, credit card companies will commonly prey upon the student's lack of knowledge resulting in the student carrying a large credit card debt. As a parent, educating the student in FICO scoring is crucial to making wise investment and financial decisions. The first lesson in FICO credit scoring, in teaching students, is the timing of scores. With the three credit bureaus providing varying scores the one item they do have in common is the need to establish at least six months of credit history before the FICO credit score is established. As credit scores are crucial to the independence of the college student, obtaining one credit card, with a low dollar limit, will provide the college student with an opportunity to establish credit and create a FICO credit score. However, ensuring the college student only used the card for necessities will be challenging. When establishing a credit card, working to keep balances low is key to obtaining a higher FICO credit score. Teach your college student to use the credit card lightly so as to ensure the credit limit to credit balance ratio remains low. As a general rule, the card balance should never exceed 30 percent of the allowed credit limit. In addition to maintaining a low credit balance, college students should be strongly urged to limit the credit cards to one. Carrying multiple cards is not a recommended financial avenue as the three major credit bureaus do not boost FICO credit scores when unnecessary credit cards are obtained. As with any financial investment tool, credit cards can provide a key life lesson to the college student. While avoiding credit cards, at all cost, is not recommended, the use of credit cards should be strictly limited while attending college. Rather than use credit cards as a means for paying for living expenses, encourage your college student to obtain a low limit card strictly for the purpose of creating and boosting a FICO credit score. In doing so, your college student will graduate from college with a degree as well as a great beginning to a stable financial future. |

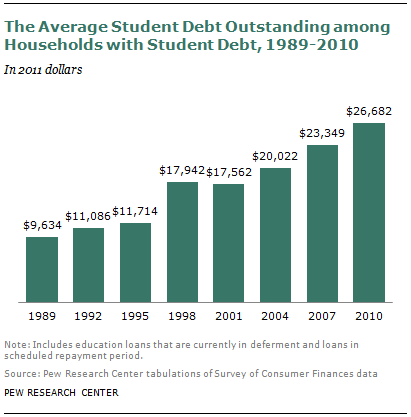

Image of average debt of college students

average debt of college students Image 1

average debt of college students Image 2

average debt of college students Image 3

average debt of college students Image 4

average debt of college students Image 5

Related blog with average debt of college students

- warlords2010.blogspot.com/... that in recent years, an average of 90 percent of the college’s students were graduating debt-free thanks in part to the school’s...

- studentlendinganalytics.typepad.com/...: The average student debt for those...increase over the Class of 2006. Average debt for the class of...18,482 at public colleges Average debt for the...

- www.nakedcapitalism.com... private colleges and ...But the spread of free ...the late 1970s, average wages... as students and their ... up on debt in order to gain...

- dandelionsalad.wordpress.com/... the ‘College Crisis’ In February of 2011, it was reported that the average debt for a Canadian family..., student loans, credit...

- patriotpainter.wordpress.com/...go to student loan debt hell. You don’t...to take out huge student loans. There...school the quality of the education ...cat could pass most college courses...like for most “average students...

- studentlendinganalytics.typepad.com/...to 4.6, and half of college students had four or.... The average (mean) balance grew.... Median debt grew from 2004...

- rexmartinez.wordpress.com/The average student loan debt for graduates of Bay State colleges in 2008 ... College, cited...to minimize student debt, especially for...

- leisureguy.wordpress.com/...students graduate debt-free. The article...mainly on Davidson College in North Carolina, but a number of colleges...school to remove student loans from...with an average grant of $36,000...

- my-wealth-builder.blogspot.com/...potential aid and average student loan debt at these colleges. I was pleasantly...by the amount of aid and the level...28,549 37 Loyola College (Md.) 3,556 $42...

- globaleconomicanalysis.blogspot.com/...I may share some of the stories. Trends in College Tuition vs. Bachelor... Meanwhile, as student debt piles up...hard enough – the average earnings...

Average Debt Of College Students - Blog Homepage Results

...consumer/credit card debt, and the average college student can be $25,000-35,000 in debt before he/she gets his/her first full-time job. This kind of debtor mindset is what ...

Related Video with average debt of college students

average debt of college students Video 1

average debt of college students Video 2

average debt of college students Video 3