About 'debt of the usa'|THE REALITY OF THE DEBT OF USA...! & Other Countries...!

Interview granted to Bankrate.com, August 2010 Q. Why would deflation happen in the United States? A. For deflation to happen in the USA, an unlikely confluence of economic developments and policy errors must occur. Unemployment must resurge and reach levels of well above 15% on a prolonged and sustained basis; consumption and, consequently, capital investment must collapse; asset prices - especially equity and residential real-estate - must crumble; the banking system must suffer a substantial contraction; the government must cut its budget deficit considerably and abruptly; and the Federal Reserve must turn strict and demonetize the economy (bleed it dry by siphoning off liquidity). None of these six doomsday scenarios is likely to materialize. The USA is probably facing years of low inflation, which has pernicious effects of its own, but is not the same as deflation. Q. How would deflation affect investment and consumption? I have trouble wrapping my head around the concept that inflated dollars are worth more and deflated dollars are worth less, for some reason. A. It is the other way around, according to orthodox monetary economics: inflated dollars are worth less and deflated dollars are worth more. Deflation means that the prices of goods and services are going down and so the purchasing power of your dollars is going up. Traditional economics claims that deflation actually increases the value of cash to its holder by enhancing its purchasing power in an environment of declining prices (negative growth in the average price level). Consumers are thus incentivized to delay their consumption. If prices are going down, why not wait and purchase the same for less later on? In my view, though, this is only true in the short-term. It is true that in a deflationary cycle, consumers are likely to delay consumption in order to enjoy lower prices later. But this paralysis in consumption is precisely what renders most asset classes - including cash - precarious and unprofitable in the long-term. On the policy level, deflationary expectations (let alone actual deflation) lead to "liquidity traps": zero interest-rates fail to stimulate the economy and the monetary authorities - unable to reduce interest rates further - remain powerless with their ammunition depleted. This means that cash balances and fixed-term deposits in banks yield no interest. But, even zero interest translates into a positive yield in conditions of deflation. Theoretically, this fact should be enough to drive most people to hold cash. Yet, what economists tend to overlook is transaction costs: banks charge account fees that outweigh the benefits of possessing cash even when prices are decreasing. Only in extreme deflation is cash with zero interest a profitable proposition when we take transaction costs (bank fees and charges) into account. But extreme deflation usually results in the collapse of the banking system as deleveraging and defaults set in. Cash balances and deposits evaporate together with the financial institutions that offer them. Moreover: deflation results in gross imbalances in the economy: delayed consumption and capital investment and an increasing debt burden (in real, deflation-adjusted terms) adversely affect manufacturing, services, and employment. Government finances worsen as unemployment rises and business bankruptcies soar. Sovereign debt (government bonds) - another form of highly-liquid, "safe" investment - is thus rendered more default-prone in times of deflation. Like inflation, deflation is a breakdown in the consensus over prices and their signals. As these are embodied in the currency and in other forms of debt, a prudent investor would stay away from them during periods of economic uncertainty. At the end, and contrary to the dicta of current economic orthodoxy, both deflation and inflation erode purchasing power. Thus, all asset classes suffer: equity, bonds, metals, currencies, even real-estate. The sole exception is agricultural land. Food is the preferred means of exchange in barter economies which are the tragic outcomes of the breakdown in the invisible hand of the market. Q. What can consumers do to protect themselves from deflation and inflation, on an investment level as well as in the broader economy? A. Inflation increases the state's revenues while eroding the real value of its debts, obligations, and expenditures denominated in local currency. Inflation acts as a tax and is fiscally corrective, but without the recessionary and deflationary effects of a "real" tax. Thus, inflation is bad for government bonds and deflation increases their value (lowers their yields). Inflation-linked bonds, though, are a great investment at all times, even with minimal deflation. Inflation also improves the lot of corporate - and individual - borrowers by increasing their earnings and marginally eroding the value of their debts (and savings). It constitutes a disincentive to save and an incentive to borrow, to consume, and, alas, to speculate. "The Economist" called it "a splendid way to transfer wealth from savers to borrowers." So, inflation is good for equity markets in the short to medium term, while deflation has exactly the opposite effect. The connection between inflation and asset bubbles is unclear. On the one hand, some of the greatest fizz in history occurred during periods of disinflation. One is reminded of the global boom in technology shares and real estate in the 1990's. On the other hand, soaring inflation forces people to resort to hedges such as gold and realty, inflating their prices in the process. Inflation - coupled with low or negative interest rates - also tends to exacerbate perilous imbalances by encouraging excess borrowing, for instance. Deflation is kind to cash and cash-equivalents (e.g., fixed-term deposits and CDs), but only in the short-term. In the long-term it has an adverse effect on all asset classes (see what happened in Japan in the 1990s) with the exception of agricultural land. |

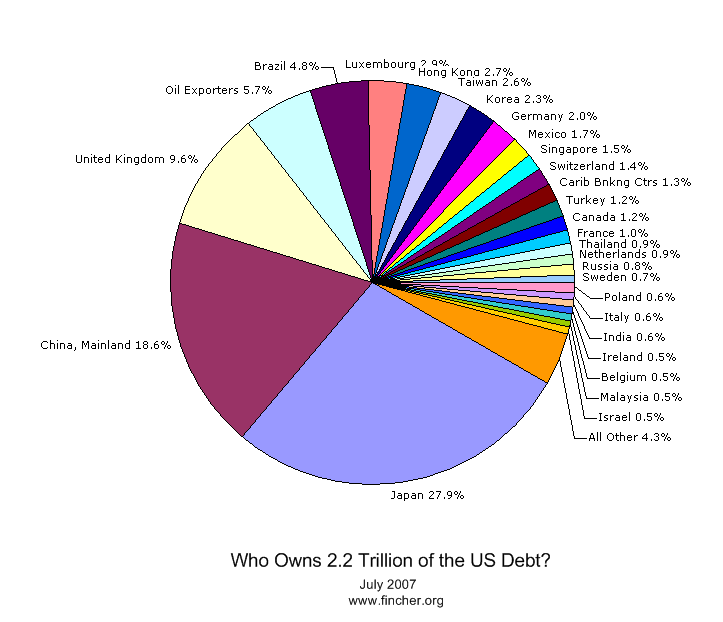

Image of debt of the usa

debt of the usa Image 1

debt of the usa Image 2

debt of the usa Image 3

debt of the usa Image 4

debt of the usa Image 5

Related blog with debt of the usa

- bleyzie.wordpress.com/...Materialism Part II – The matter of a possible USA debt default… By: Herman... of the Eastern Bloc , and...Materialism Part II – The matter of a possible USA debt default… 24th...

- the-games-veda.blogspot.com/... in the history of mankind ... Solving the USA debt crisis negotiation crisis... of Marvel Vs Capcom 3 could solve the USA debt Crisis before the Aug...

- logicalities3.blogspot.com/... ARE ....! : The debt of USA is 8,720 Billion US$ , that ...work for the KING, and run all. The Court of the KING, is parallel, and above the supreme...

- serafinol.blogspot.com/...wrong with the good old USA. According to...Mandelbaum, a great deal of what’s wrong with us...infrastructure. We can’t improve the quality of education. We...Government, we can solve the debt crisis. In fact, if every...

- stopwarsaveearth.blogspot.com/...and their ability to grow and develop the Middle Class and economies. THE STRUCTURAL DEBT of the USA has and is the problem and the Republicans (Tea Party) do not...

- stopwarsaveearth.blogspot.com/... the federal government's debt. I am confident Secretary of the Treasury could elaborate to the credit worthiness of the USA, especially considering its currency...

- fittoblog.blogspot.com/

Eurogroup President US And Japan Under The Insolvency Bus: "The Debt Level Of The USA Is Disastrous"

... to highlighting the problems of the US: " The debt level of the USA is disastrous, " Mr. Juncker said. " The real problem is that no one... - scientific-child-prodigy.blogspot.com/...it looks like the national debt will soon have the power to bring it down. It is a pity to note it, but the USA’s lauded version of democracy doesn’t seem to be...

- tomfaranda.typepad.com/folly/... to dump USA bonds - ...try to blame it on the Tea Party . ( UPDATE: It...There will be a kind of cascade effect, ...in the debate over the debt had made the...

- stopwarsaveearth.blogspot.com/... by no means broke.... The current USA debt is directly related to the unchecked spending of the Bush/Cheney domestic failure to garner a sincere economy...

Debt Of The Usa - Blog Homepage Results

A PLEA TO THE UNITED STATES PRESIDENT AND CONGRESS FOR HELP

...Pittsburgh(DTD @ PIT)--an advocacy group--part of a faith-based network to cancel the debt of impoverished nations (an affliate of Jubilee USA Network--www.jubileeusa.org) Meetings: TUESDAYS, 8-9:30pm, Posvar Hall...

...article that probably explains the debt crisis in the USA the best and why we are where we...President Obama having to serve his term of office with this weight on his ...

Related Video with debt of the usa

debt of the usa Video 1

debt of the usa Video 2

debt of the usa Video 3