About 'debt consolidation loan student'|Student Loan Debt Consolidation

As debt grows, it becomes harder and harder to pay off each month. The rising monthly payments typically do not help a consumer lower their debt, and many times they can cripple his/her budget to the point of bankruptcy. With a few steps, a borrower can work to reduce debt payments and break the cycle of debt for good. It takes organization, discipline and hard work, but it can be done.Credit Card Debt Step 1 Gather all credit card debt statements. Step 2 Find each credit card company's contact information. Step 3 Call each credit card company and ask for a reduction in your interest rate, if you have paid on time for a full year. Additionally, ask for any balance transfer options. If there are any available, take advantage of the lower interest rates to consolidate your credit card debt and lower your monthly payments.Installment Debt Step 1 Gather all of your installment debt statements, such as lines of credit, mortgage loan, car and student loans. Step 2 Find the contact information for each lender on the statement. Call each one and ask for a loan modification. This is a free or low cost process that lowers your monthly payment if you are struggling to repay the debt. If not an option, request a lower interest rate or monthly payment. Step 3 Consider a debt consolidation loan or mortgage refinance to consolidate as many debts as possible into one note. This should lower your overall monthly debt payments and make them easier to afford. Ask your lenders for terms, rates, and fees to see if it is a viable option for your situation.Pay Off Debt for Good Step 1 Rank all of your debts from lowest monthly payment to highest, once you have lowered your monthly payments. Step 2 Look over your family's budget and see if there are any areas where you could reduce spending and allocate more funds towards debt reduction. Attempt to earn extra money through overtime, extra hours, or selling unused household items. Step 3 Begin to funnel any extra money towards the smallest monthly payment debt while only paying the minimum payment on all other debts. Once it is paid in full, allocate all the funds spent on the smallest monthly payment towards the next smallest monthly payment. Continue the pattern until all debts are paid in full. Tips Chart your progress. This will not only help you to see what you have accomplished, but will help you to see if there is room for improvement. Create a spreadsheet that shows the highest amount of debt owed and how much you have reduced it each month. Warnings Avoid debt reduction plans. While these types of plans reduce the balance on the debt owed, they will negatively impact your credit score. Remember, if it sounds too good to be true, it probably is. Dave Ramsey: http://www.daveramsey.com/article/get-out-of-debt-with-the-debt-snowball-plan/ AllBusiness.com: http://www.allbusiness.com/personal-finance/credit-cards-credit-card-debt/2442-1.html |

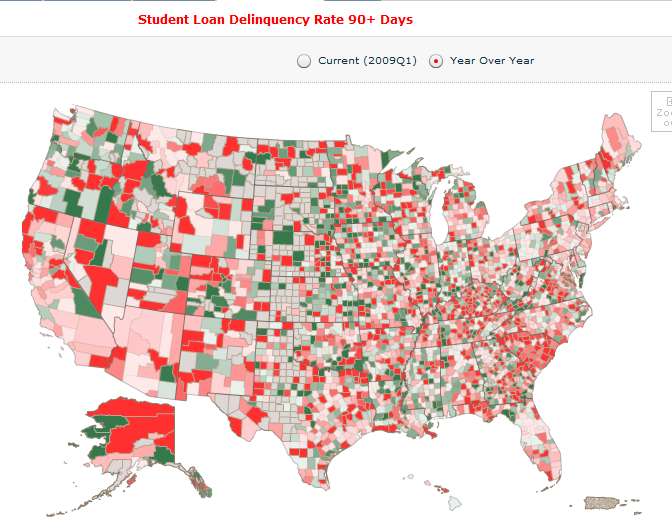

Image of debt consolidation loan student

Related blog with debt consolidation loan student

- studentloanconsolidationprivate.wordpress.com/... the risk of a loan, and thus saves the borrower's creditworthiness. Student debt consolidation loan is one way to eliminate debt that students refer to all their ...

- alwaysanswer.wordpress.com/...Question by Jellybean : When you get a student debt consolidation loan, do you have to use it for that? Even... to have you provide all your student loan statements, and then ...

- thefuturegroom.blogspot.com/...a daunting task all the student loan debt consolidation to make the debt consolidation plan...as an option, and the student loan debt consolidation are conveniently ...

- consolidatestudentloansinfo.wordpress.com/...the implementation of the programme of studies, it would consider private student loan debts with consolidation refinancing . Repay a loan is something you must do so in the end, can...

- your-student-debt.blogspot.com/...the future. You will never have to worry again about the stress when you sign up to a student loan debt consolidation organization. You know when you go out with your friends to socialize and you...

- studentloaniowa.wordpress.com/...advantage of student loan consolidation . By taking this...now is the future. Student Loan Application is the...career in motion, already in debt. This is the danger...

- federalstudentloanrepaymentassistance.wordpress.com/All About Getting A Student Loan Debt Consolidation After four or more years of... now. Read More Student Loan Debt Consolidation This entry was posted...

- your-student-debt.blogspot.com/...have not heard of debt consolidation for students loans. Let me explain. Debt.... If you think debt consolidation is right for you then...

- officeexecutivechair.wordpress.com/...to colleges and universities eac Read more post at Learn More About Student Loan Debt Consolidation .

- shine.yahoo.com/blogs/author/ycn-1238193/...loans, to lock in a fixed interest rate and lower your monthly student loan payment. Debt Consolidation - Bad Credit Debt Relief, Loans, Consolidate , Student Loan Consolidation ...

Debt Consolidation Loan Student - Blog Homepage Results

Related Video with debt consolidation loan student

debt consolidation loan student Video 1

debt consolidation loan student Video 2

debt consolidation loan student Video 3