About 'average student credit card debt'|...after new college students: kids who...suicide to escape debt, and one about...s experience with credit card bills... for average citizens...

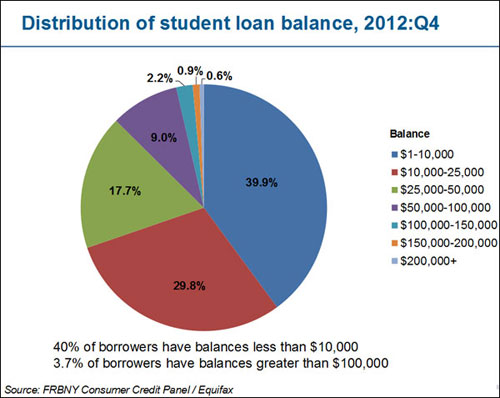

Remember that movie with the guys in Vegas? Well this story is worse. I remember when I first began looking at prospective colleges when I was just a junior in high school. The main thing I dreaded over was how my family and I would afford to pay for college outside of scholarships and grant money. The answer was student loans. I was so excited when I chose the university I would attend and that my financial aid application was accepted. In my mind, like countless others, I rationalized my thinking on my future student loan debt by telling myself everyone does it and I'll only borrow what I need. The promise of a great education, secure financial future, and a once in a lifetime opportunity to go away to college with the help of student loans can be a recipe for financial disaster. Unsuspecting students and society as a whole face consequences when we are not careful and diligent when it comes to investing in our future. The total outstanding student loan debt now exceeds over $1 trillion and Americans as a whole now owe more in student loans than credit card debt. At the time I signed my loan documents to help pay for school, I remember thinking that I was making an investment in my future and that it was for the greater good long term. I was convinced that this debt would be 'good' debt for me b/c once I started paying for them I'd be building my credit and I could always consolidate all the loans into one low monthly payment. One time in college when it was time to sign the documents to receive another student loan, the lady in the financial aid office told me I could get as much as I needed. To this day I can still recall an overwhelming desire to take out a lot more than I needed to have some fun with extra money even though it would all have to be paid back. After coming off of my temporary high, I began to think that this 'free money' should not be this easy to get for a college student. It was as if I were being given the key to a bank vault. I've personally known people who knowingly took out a lot more student loans than they needed simply because they could not because they needed it. Students today take out student loans for a lot more reasons other than paying for school because it's readily available. Rent, clothes, spending money, etc are just some of those reasons. Now that I look back on everything, Americans got drunk on student loans. The availability, deregulated interest rates, and overall need has convinced almost everyone who really wants to go to college that student loans are the best way to go to finance higher education. Society has brainwashed students into thinking that higher education is the best way to secure their future. With the average student backed into a financial wall, they turn to student loans to bridge the gap. According to The Atlantic http://www.theatlantic.com/business/archive/2011/08/chart-of-the-day-student-loans-have-grown-511-since-1999/243821/, student loan debt has risen 511 % since 1999. There are 2 main reasons that have caused student loan debt to skyrocket: 1. the continual rising cost of college tuition and 2. over inflation of other college expenses. It's no secret that the cost to attend college has increased significantly over the last 2 decades while Americans' income has failed to keep pace. Each year it seems the public and private schools raise their tuition and fees. College expenses (books, housing, meal plans, admin. fees etc) are also over inflated. This over inflation is due to the availability of student loans. As long as they are available, these expenses will continue to rise b/c they know students will get the money to pay for them. The only way I see the problem can be fixed is for colleges and universities to cap their costs of tuition and fees as well as for the government and/or financial lending institutions to either cut the APR on student loans in half or charge no interest at all for a specific time period of the loan. There have been rumblings that student loan forgiveness should be put into law but that will only make things worse. Our society would end up being well educated but even more financially illiterate and irresponsible. Americans in this country got drunk on student loans. Using them to pay for any and all other expenses other than education made it seem like the right thing to do at the time. Now that the hangover has set in (down economy, lack of jobs, deferment, creditor calls, late fees, etc.) it is a harsh reality for many Americans and it's starting to take its toll. While student loans can be considered the new 21st Century gold rush, Americans got lazy and felt like they didn't need to work or find alternative methods to help pay for their education b/c they could always obtain a student loan. Now that the 'high' is over, it's time that Americans face the facts about the importance of having financial literacy, being more entrepreneurial minded, and work on saving more as a culture and society. |

Image of average student credit card debt

Related blog with average student credit card debt

- studentlendinganalytics.typepad.com/...of college students had four or more cards. ...record-high credit card .... The average (mean) balance.... Median debt grew...

- rougeknights.blogspot.com/...after new college students: kids who...suicide to escape debt, and one about...s experience with credit card bills... for average citizens...

- rogerhollander.wordpress.com/.... But debt incurred...than 1,500 college students by US PIRG in...at least one credit card. Seniors... an average debt of $2,623...

- moneygal2020.wordpress.com/...card debt: $16,007* -*Average APR on credit card with a balance on it... debt (98 percent of which...Mae, “How Undergraduate Students Use Credit Cards...

- economicfolk.blogspot.com/...Student loan debt outpaced credit card debt for the first time last... this year as more students go to college and a...college with an average of $24,000 in debt...

- shine.yahoo.com/blogs/author/ycn-1137265/... when most college students turn to credit cards and likewise expose themselves to the wonderful world of credit-card debt. The average undergraduate in 2008 ...

- smartpei.typepad.com/robert_patersons_weblog/... average is...that Scottish students do not have... by easy credit? More here on...student-loan debt exceeded total credit-card debt ...

- howtodealwithcreditorsandgetoutofdebt.blogspot.com/...have credit cards, and the average undergrad has $2,200 in credit card. Additionally, they will amass almost $20,000 in student debt. "(Source: Nellie Mae, "Undergraduate...

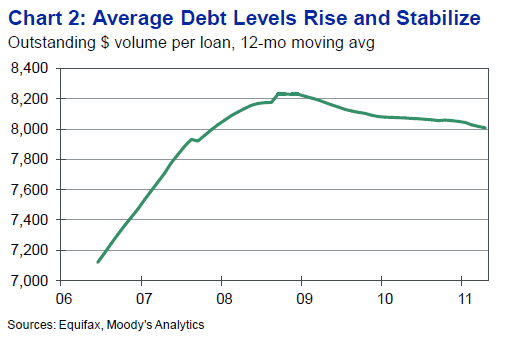

- blog.500startups.com/...That’s how mad we are at debt. [5] The average outstanding balance on graduate student credit cards is $8,612 in 2006 (median...

- shine.yahoo.com/blogs/author/ycn-1117833/...commit to paying off your debt as quickly as possible. 2. Pay off your bills. Credit cards charge an average interest rate of 14 percent. A...

Average Student Credit Card Debt - Blog Homepage Results

Related Video with average student credit card debt

average student credit card debt Video 1

average student credit card debt Video 2

average student credit card debt Video 3