About 'student loan indebtedness'|College graduates struggle to repay student loans

You must report the cancellation of personal debt on your income tax return. When an owed debt by either a person or business entity is cancelled or forgiven, some amount of taxable debt income may be generated since the benefit of the amount borrowed in the past is no longer associated with the burden of repayment now or in the future. Cancellation of debt (COD) is reported to both taxpayer and the tax authority on IRS Form 1099-C. This information is transferred, for personal debt, to Line 21 on IRS Form 1040. Business debt, depending on the nature of the business, is transferred to IRS Form 1040 Schedules C, E or F. Two general types of indebtedness The two general types of indebtedness; recourse and non-recourse debt are distinguished by personal liability. A borrower is personally liable for recourse debt; they do not alternatively have the same personal obligation in the case of non-recourse debt. Taxable income arising from the cancellation of recourse debt can occur whether or not property is returned or surrendered. Surrendering property in full or partial payment of a recourse debt is actually treated as a "sale" of that property at "fair market value". Debt income is usually "generated" when the cancelled or forgiven amount of money owed exceeds the value of the property surrendered in payment of the outstanding debt. Thus, repossession and foreclosure are both treated as a sale or exchange of property and the rules of gain or loss consequently apply. Similarly, in the case of recourse debt secured by abandoned property, ordinary taxable income can also be realized if the debt is cancelled. Alternatively, any money realized from the sale of property to satisfy non-recourse debt is considered the amount of debt cancelled; there is no excess amount over fair market value recorded. There are exceptions! There are several exceptions where the reporting of taxable income from cancellation of debt does not apply. There is no taxable income derived from situations where the cancellation of an outstanding debt is intended as a gift or represents deductible debt. In the latter case, there is no perceived debt income if the paid debt would have been a deductible tax item, such as a business expense, if it had been a non-recourse loan (discussed above), or some student loans with special contract provisions regarding the performance of services in lieu of full payment. Similarly, cancellation of debt in a bankruptcy proceeding, qualified farm or real property business indebtedness, or specific situations where an individual proves their insolvency immediately before discharge of the cancellation of debt do not generate taxable debt income. Two information documents are used when reporting cancellation of debt; the IRS Form 1099-A, Acquisition or Abandonment of Secured Property and the IRS Form 1099-C, Cancellation of Debt. The proper reporting of either of these documents on an income tax return is best left to an experienced tax preparer. Do NOT overlook COD events when filing your return. For more information, visit the IRS website, IRS.gov. References Internal Revenue Service, www.irs.gov/formspubs/index.html, Forms and Publications |

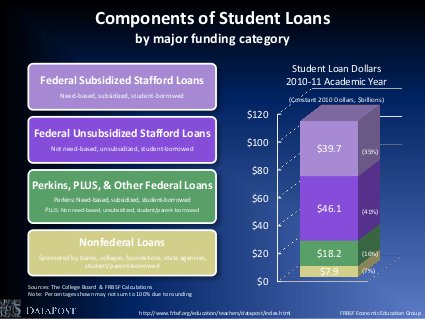

Image of student loan indebtedness

Related blog with student loan indebtedness

- graduallygettingwealthy.wordpress.com/... by student loan debt is... on the indebtedness list for a long...a very frugal student). Oh, and apply for...tackle those loan payments...

- shine.yahoo.com/blogs/author/ycn-1208713/... very, very different. There s been a lot of attention paid to student loan indebtedness, says Catherine Hill, Ph.D., AAUW s director of research and co-author of the recent...

- sdmisra.wordpress.com/...the possibly diminished advantage in lifetime earnings, the increase in student loan indebtedness may present greater financial dilemmas for college graduates...

- lawprofessors.typepad.com/legal_skills/...students have returned to school, further driving up their indebtedness. Average student loan debt recently topped $25,000, up 25 percent in 10 years. And the...

- improvinghighereducation.wordpress.com/... , debtors , debts , discharge , education , financing , higher , indebtedness , lenders , loans , students , undue hardship , university

- mediamatters.org/blog/...students have returned to school, further driving up their indebtedness. Average student loan debt recently topped $25,000, up 25 per cent in 10 years. And the...

- cnvproductions.blogspot.com/...It's difficult for me to understand why we can't treat student loans the way we treat some other indebtedness." Since the law stopped allowing private student loans...

- thenewfacultymajority.blogspot.com/...the same burden of student indebtedness. It's time to join ... also International Students Day , established...a quick history on student loan law. Mike Konzcal graphed...

- aspanational.wordpress.com/...and a comfortable lifestyle, but the constant indebtedness of student borrowers has become... cost in tuition and student loan interest rate expected to double...

- themoneycoach1.wordpress.com/..., and get their student loan payments greatly reduced...loans – and they can cancel out your loan indebtedness. To start the process of claiming...

Related Video with student loan indebtedness

student loan indebtedness Video 1

student loan indebtedness Video 2

student loan indebtedness Video 3